A vast number of companies and people regularly utilize AI tools such as ChatGPT nowadays. Even though significant progress was made in the past 12 to 24 months, this technological upheaval is only starting.

While estimates differ, virtually all analysts anticipate substantial expansion in both technology and its demand within this decade. For instance, according to the United Nations Conference on Trade and Development, artificial intelligence could grow into an $4.8 trillion market by 2033, rising sharply from approximately $189 billion in 2023.

Where should you put your $1,000 investment at this moment?

Our analysis group has just disclosed their thoughts on what they consider to be the

10 best stocks

to buy right now.

Continue »

At the start of 2025, numerous AI stocks faced temporary dips. It remains uncertain what lies ahead; however, it’s quite evident that the three AI companies listed here could potentially see their worth skyrocket within this same year.

NVIDIA remains the top player in the field of artificial intelligence.

If you aim to ensure your investment portfolio benefits from advancements in artificial intelligence, purchasing stocks in related companies could be a good strategy.

Nvidia

(NASDAQ: NVDA)

It’s a clear choice. Personally, I believe no other business is as closely aligned with the surge in AI technology developments.

Nvidia does not focus on producing AI products or services. Rather, it manufactures graphics processing units (GPUs).

GPUs

These processors enable developers to handle the large volumes of data required for training and running AI models as well as various machine learning tasks.

Without graphics processing units (GPUs), the current artificial intelligence transformation might not be happening. At present, Nvidia holds sway over the sector with an impressive 80% to 95% of the GPU market dedicated to AI-specific functions.

Previous advancements in chip technology indicate that competitors will likely close the gap with Nvidia’s technological edge over time, reducing its substantial market dominance. However, Nvidia possesses an ace in the hole: CUDA, a development platform enabling clients to tailor their chips for particular uses.

CUDA deeply integrates users into its software and hardware ecosystem, leading to strong customer loyalty.

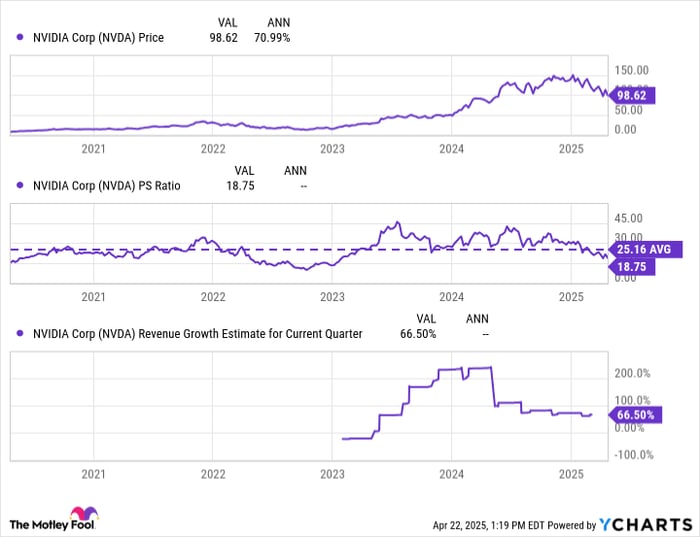

Although the stock appears expensive with a price-to-sales ratio of 18.4, this figure is still significantly lower than its five-year trailing average. Coupled with robust sales growth, this presents an excellent opportunity for a long-term investment during the current downturn.

NVDA

data by

YCharts

; PS = Price-to-Sales ratio.

Do not overlook these two “stealth” AI firms.

Many individuals might not consider

Microsoft

(NASDAQ: MSFT)

or

Amazon

(NASDAQ: AMZN)

As AI firms, however, these two enterprises stand out predominantly in relation to their involvement with artificial intelligence. This prominence does not stem from Amazon’s extensive e-commerce operations or Microsoft’s Office products. Rather, it is attributed to their respective strengths in the domain of cloud computing services.

Amazon refers to this segment as Amazon Web Services (AWS), whereas Microsoft’s equivalent is called Azure. As we will explore, these two divisions are major catalysts in the current advancements within the AI sector.

The largest purchasers of Nvidia’s GPUs are not directly the AI firms themselves, but rather cloud service providers such as AWS and Azure. These cloud infrastructures function akin to scalable, distributed computers capable of expanding or contracting instantly with ease — an ideal modular setup for AI enterprises aiming to experiment with and roll out their solutions.

With 30% and 24% market shares, respectively, AWS and Azure dominate the cloud computing space, and thus the AI space when it comes to actually building and delivering these services to customers.

Clearly, cloud computing significantly surpasses establishing individual computational setups for each artificial intelligence enterprise. With additional funds available to allocate towards premium technologies such as Nvidia’s graphics processing units, both Amazon Web Services and Microsoft Azure ought to maintain their substantial market positions effortlessly, ensuring they remain pivotal players in the AI transformation over many years ahead.

Despite having more varied business strategies, neither firm is expanding as rapidly as Nvidia. Instead, shareholders get significantly reduced valuations. Over time, as the field of artificial intelligence expands ever wider, anticipate the market will start viewing these companies less as broad-ranging conglomerates and more akin to essential providers within the critical domain of AI.

Is it wise to put $1,000 into Nvidia at this moment?

Before purchasing Nvidia stocks, keep this in mind:

The

Motley Fool Stock Advisor

The analyst team has recently pinpointed what they think could be the

10 best stocks

For investors looking to purchase now… Nvidia was not among them. The 10 stocks selected have the potential to generate significant gains over the next few years.

Consider when

Netflix

created this list on December 17, 2004… should you have invested $1,000 following our suggestion,

you’d have $561,046

!*

Or when

Nvidia

created this list on April 15, 2005… should you have invested $1,000 based on our recommendation at that time,

you’d have $606,106

!*

Now, it’s worth noting

Stock Advisor

’s total average return is 811% — a market-crushing outperformance compared to

153%

For the S&P 500 index. Ensure you don’t miss the most recent top 10 list, which becomes accessible upon joining.

Stock Advisor

.

Check out the 10 stocks here »

*Stock Advisor returns as of April 21, 2025

John Mackey, who previously served as CEO of Whole Foods Market, which is now owned by Amazon, sits on The Motley Fool’s board of directors.

Ryan Vanzo

does not hold any shares in the stocks discussed. However, The Motley Fool holds positions in and endorses Amazon, Microsoft, and Nvidia. Additionally, they recommend certain options for Microsoft: buying long-term call options at $395 with an expiration date in January 2026 and selling call options at $405 with the same expiry month and year. Furthermore, The Motley Fool has a

disclosure policy

.